Regulatory compliance is essential for seamless inheritance and property rights management, ensuring fairness and transparency. Compliance issues can arise at any stage of property transfer, requiring legal expertise in areas like probate laws, tax regulations, and white-collar defense. Navigating complex regulatory landscapes involves understanding state laws, tax implications, and addressing concerns from philanthropic and political communities. Engaging specialized legal experts and leveraging technology helps mitigate risks, ensuring compliance and the dismissal of criminal defense concerns related to inheritance property ownership legal challenges.

Regulatory compliance is a cornerstone of any robust legal framework, especially regarding inheritance and property rights. As laws evolve, so do the complexities of ownership, particularly in inheritance matters. This article delves into the intricate relationship between regulatory compliance and inheritance property ownership, exploring legal challenges and navigating regulatory hurdles. We present case studies from real-world scenarios to provide insights and offer strategies for professionals seeking to ensure fairness in property transfers, addressing critical issues related to inheritance property ownership legal challenges.

- Understanding Regulatory Compliance: A Foundation for Inheritance and Property Rights

- The Complexities of Ownership: Legal Challenges Arising from Inheritance

- Navigating Regulatory Hurdles: Ensuring Fairness in Property Transfer

- Case Studies: Unraveling Real-World Issues in Inheritance Property Ownership

- Strategies for Compliance: Tools and Resources to Overcome Legal Challenges

Understanding Regulatory Compliance: A Foundation for Inheritance and Property Rights

Regulatory compliance is a cornerstone for individuals seeking to navigate the complexities of inheritance and property rights. Understanding these regulations is crucial as they provide a framework that ensures fairness, transparency, and protection for all parties involved—from the individual transferring assets (grantor) to the recipient (beneficiary). Compliance issues can arise at every stage, from the initial planning to the final execution, posing significant legal challenges.

For instance, proper documentation, including wills, trusts, and power of attorneys, is essential. These legal instruments must adhere to specific regulations to be valid and enforceable. Furthermore, the transfer of property, whether during life or through inheritance, involves a detailed understanding of tax implications, estate planning, and potential regulatory hurdles unique to different asset types. A general criminal defense strategy, while valuable for addressing potential legal issues, may not suffice when dealing with the intricate web of inheritance and property ownership regulations.

The Complexities of Ownership: Legal Challenges Arising from Inheritance

The complexities of ownership transition, particularly through inheritance, introduce a unique set of legal challenges. When property changes hands from one generation to the next, various factors come into play, including varying state laws, tax implications, and potential disputes among heirs. This can lead to convoluted situations where corporate and individual clients alike face intricate legal matters. The process is often fraught with unexpected complexities, especially when dealing with real estate or substantial assets.

These inheritance-related issues demand a meticulous approach from general criminal defense attorneys who possess an unprecedented track record in navigating such scenarios. Understanding the nuances of probate laws and tax regulations is crucial to ensuring a smooth transition for clients. By carefully managing these legal challenges, attorneys can help mitigate potential conflicts among heirs and ensure the valid transfer of property ownership.

Navigating Regulatory Hurdles: Ensuring Fairness in Property Transfer

Navigating complex regulatory landscapes is paramount when dealing with inheritance and property ownership, as legal challenges can arise at every turn. The fairness of property transfer relies on adherence to laws governing succession and real estate transactions. These regulations are designed to protect the rights of all stakeholders, ensuring a transparent and equitable process.

One significant hurdle involves addressing philanthropic and political communities’ concerns regarding inheritance tax evasion or avoidance. Winning challenging defense verdicts against such accusations demands meticulous record-keeping and compliance with tax disclosure requirements at every stage of the investigative and enforcement process. This includes proper documentation of property valuations, gift transfers, and charitable donations to mitigate potential legal risks.

Case Studies: Unraveling Real-World Issues in Inheritance Property Ownership

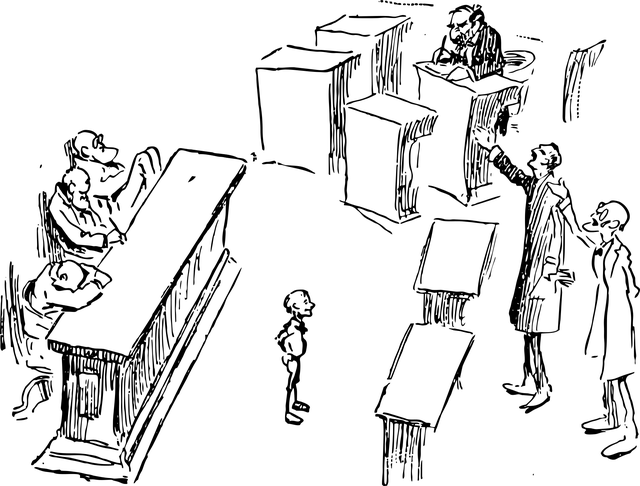

In the realm of inheritance property ownership, navigating legal challenges is akin to traversing a labyrinthine tapestry woven with intricate threads of law and tradition. Case studies reveal real-world issues that underscore the complexity of this landscape. For instance, disputes often arise when beneficiaries contest the validity of wills, questioning the intentions behind the distribution of assets. These battles can involve not just family members but also philanthropic and political communities, highlighting the far-reaching implications of inheritance laws.

Moreover, white-collar defense plays a pivotal role in these cases, as legal strategists wield their expertise to navigate regulatory compliance issues. Winning challenging defense verdicts requires a meticulous understanding of statutes and precedents. By delving into these intricate matters, legal professionals not only safeguard the interests of individuals but also ensure that the broader philanthropic and political communities remain stable and just, fostering an environment where inheritance property ownership can thrive within established legal boundaries.

Strategies for Compliance: Tools and Resources to Overcome Legal Challenges

Navigating regulatory compliance issues, especially regarding inheritance property ownership legal challenges, can be a daunting task for individuals and businesses alike. However, there are robust strategies and resources available to overcome these hurdles. One effective approach is to proactively engage with legal experts specializing in inheritance and property law. These professionals offer invaluable insights into the intricacies of compliance requirements, ensuring that every step taken aligns with current regulations. They guide their clients through all stages of the investigative and enforcement process, providing strategic advice tailored to specific circumstances.

Additionally, leveraging specialized software and online platforms designed for regulatory compliance can significantly streamline the process. These tools facilitate efficient tracking of changing laws and regulations, enabling businesses to stay ahead of potential legal challenges. By combining expert guidance with cutting-edge technology, individuals and entities involved in inheritance property ownership can ensure not only compliance but also the complete dismissal of all charges related to general criminal defense concerns.

In navigating the intricate landscape of inheritance and property rights, understanding and adhering to regulatory compliance issues is paramount. The complexities surrounding ownership, as highlighted in this article through case studies, underscore the need for fairness and transparency in property transfers. By employing strategies such as leveraging available tools and resources, professionals can effectively overcome legal challenges associated with inheritance property ownership. This ensures not only adherence to regulations but also protects the interests of all stakeholders involved.